Market update

The national housing market continues to recover, evidenced by a balanced supply of inventory as well as improvements in home prices and the number of homes sold. The median home price increased again this month from last month, reaching $182,000 compared to $155,600 just three months ago, a 17.4% increase.

Recently, a growing trend facing certain regions is tremendous inventory shortages. NAR President Moe Veissi advised buyers in markets with limited supply who are seeing multiple bidding and competition between first-time buyers and cash investors that, "It's extremely important (for buyers) to listen to the advice of your agent and perform all the due diligence that you would normally do in a more balanced market".

With rental rates and buyers' confidence on the rise due to record-low mortgage rates, the market is heating up, making now one of the most favorable times in history to buy a home.

Mortgage rates around 3.66% continue to boost home affordability, some of the lowest rates on record since 1971. These rates may be as close to the bottom as they will get, adding to the urgency to buy a home now while these record lows hold.

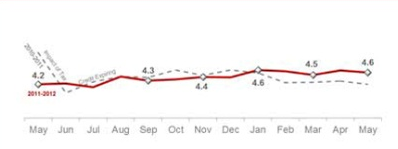

While home sales decline 1.5% from last month to 4.55 million units, year-over-year increases are 9.6% higher. Lawrence Yun, NAR chief economist, states, "home sales have moved markedly higher with eleven consecutive months of gain over the same month a year earlier".

Thanks to a decline in distressed properties on the market (which includes short sales and foreclosures that traditionally sell for 15%-20% less on average compared to non-distressed homes), the median home price rose 5.1% from last month, and 7.9% compared to a year earlier to $182,600. This is the third consecutive month of year-over-year price gains, which hasn't been seen since March to May of 20096, a period of peak performance in the housing market.

Housing inventory remained stable with a 6.6 month supply on the market, 20% below a year ago levels. This marks the sixth consecutive month of inventory at 6 month supply, the threshold for a balanced market, giving both buyers and sellers an equal advantage. Movement out of the three year buyer's market is imperative toward reaching a full-scale housing market recovery.

As many markets continue to heat up, both buyers and sellers are facing multiple offer situations. If you're a buyer in a bidding war, here are some tips to give you an edge:

1. Think unevenly. An uneven offer price such as $251,000 instead of $250,000, will stand out from the others, and it may just beat an offer that came in at a slightly lower figure with an even bid.

2. Be flexible. The fewer contingencies and the cleaner the offer, the better the chance you have to win a bidding war. Having your agent find out the seller's ideal closing date, and offer to make it happen.

3. Hide your hand. Determine the highest bid you're trying to beat, and try to come in over that rather than offering the most you can afford.

4. Don't get distracted. If you find yourself caught up in the excitement of a bidding war, step back and reassess if the home has everything you want and need.